Value added tax - VAT

His Highness Sheikh Hamdan bin Rashid Al Maktoum, Deputy Ruler of Dubai, UAE Minister of Finance and Chairman of the Federal Tax Authority (FTA), has...

Sunday 07 July 2019

WTS Dhruva Consultants, is a boutique tax advisory firm and FTA registered tax agent with a presence in the UAE, KSA and Bahrain, have published a...

Saturday 06 July 2019

Abu Dhabi National Exhibitions Company (ADNEC) today announced that it has obtained FTA License for waiver from Value Added Tax (VAT) for all...

Thursday 13 June 2019

Self-Service Kiosks to Be Introduced Allowing Tourists to Recover VAT without Dealing with Employees

Self-service kiosks have been set up across all of the ports included in the Tax Refunds for Tourists Scheme in order to allow tourists to recover...

Tuesday 11 June 2019

“The rates of compliance with tax laws and procedures have increased exponentially among all taxable businesses,” said His Excellency Khalid Ali Al...

Wednesday 15 May 2019

The Federal Tax Authority (FTA) has started implementing the Value Added Tax (VAT) Refunds for Business Visitors procedure, noting that a dedicated...

Tuesday 02 April 2019

The Board of Directors of the Federal Tax Authority (FTA) has issued a number of executive decisions concerning the Authority’s operations and...

Tuesday 26 March 2019

The Federal Tax Authority (FTA) asserted that passively earned interest income from bank deposits and dividend income are outside the scope of Value...

Tuesday 12 February 2019

The majority (84 percent) of recruiters and human resource (HR) professionals remain confident about their ability to recruit the right candidates...

Wednesday 06 February 2019

The Federal Tax Authority (FTA) is preparing to launch an awareness campaign on Tax Invoices tomorrow (Sunday, February 3, 2019) in Abu Dhabi markets...

Saturday 02 February 2019

The Federal Tax Authority (FTA) has announced the launch of a new field campaign to engage business and consumers in the local markets and raise...

Sunday 27 January 2019

The Federal Tax Authority (the “Authority”) explained that the Federal Decree-Law No. 8 of 2017 on Value Added Tax has defined the cases for tax de-...

Saturday 26 January 2019

The reduction of the value-added tax (VAT) registration threshold to SR 375,000 from January 1, 2019, will increase the taxpayer base by 150,000,...

Sunday 20 January 2019

The Federal Tax Authority (FTA) has outlined four conditions that would allow foreign businesses to recover Value Added Tax (VAT) incurred in the UAE...

Saturday 19 January 2019

The Federal Tax Authority (FTA) has confirmed that the date of supply for Value Added Tax (VAT) with regard to Independent Directors’ services is...

Saturday 12 January 2019

WTS Dhruva Consultants, a boutique advisory and FTA registered Tax Agent with presence in UAE, KSA and Bahrain, conducted a seminar recently on Value...

Saturday 12 January 2019

The Federal Tax Authority (FTA) has set the conditions and methods for Input Tax apportionment for businesses making mixed supplies (taxable and...

Tuesday 08 January 2019

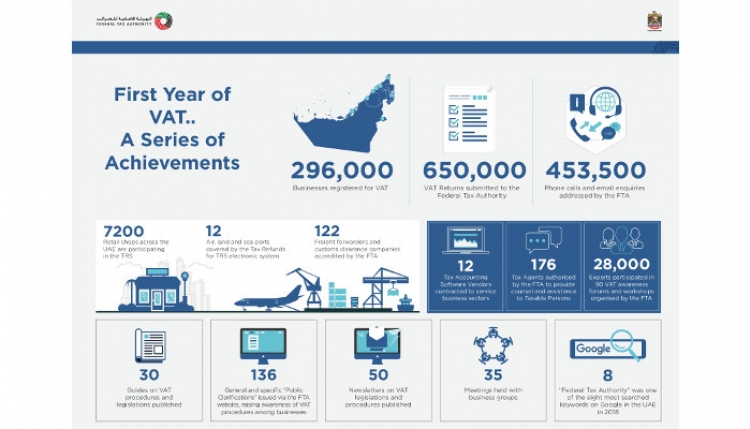

His Excellency Khalid Ali Al Bustani, Director General of the Federal Tax Authority (FTA), asserted that in the first year of implementing Value...

Saturday 05 January 2019

After successfully launching its Value Added Tax (VAT) calculator App in the summer, Businessmentals has announced an exciting addition to their VAT...

Thursday 20 December 2018

The Federal Tax Authority’s (FTA) Board of Directors discussed Value Added Tax (VAT) Refund Scheme for Foreign Businesses at its 7th meeting, held...

Monday 10 December 2018

- 1 of 6

- >

Most Popular

Tuesday 20 March 2018

Sunday 18 March 2018

Saturday 10 March 2018

Tuesday 27 February 2018

Thursday 22 February 2018

Wednesday 14 February 2018

Tuesday 16 January 2018