Kuwait - MENA Herald: Warba Bank K.S.C.P (“Warba”) announces the successful Sukuk issuance of their perpetual, non-callable (before five years), Tier 1 Basel III compliant USD 250 million Mudaraba Sukuk Certificates.

In a joint press release, Warba Bank highlighted that the issuance is compliant with the Tier 1 requirements by the Central Bank of Kuwait (“CBK”), and conforms to the Basel III guidelines. The callable USD 250 million perpetual sukuk was issued at a coupon rate of 6.50% with the first call date set on the 14th of March, 2017. The sukuk issuance was oversubscribed by 5 times, amounting to approximately USD 1.3 billion. The sukuk issuance was well received by local and international investors alike, which is displayed through the diversified geographical coverage with investors out of Kuwait subscribing by 27%, MENA region by 43%, Europe and the United Kingdom by 22%, and Asia by 8%.

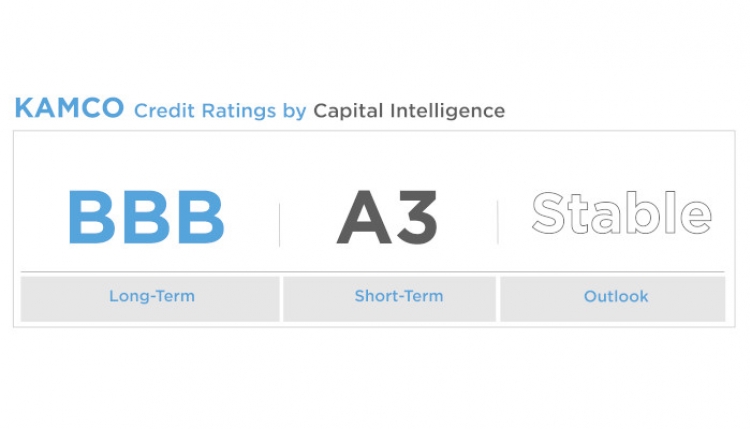

Bank ABC, Emirates NBD Capital, KAMCO Investment Company K.S.C. (Public) (“KAMCO”), KFH Capital Investment Company K.S.C.C (“KFH Capital”), Noor Bank, and Standard Chartered Bank acted as Joint Lead Managers & Bookrunners for this issuance, listed in alphabetical order.

Mr. Shaheen Hamad Al-Ghanem, Chief Executive Officer of Warba said, “Warba is pleased with the overall outcome of this Tier 1 Basel III compliant sukuk issuance. We would like to extend our gratitude and appreciation towards our trusted investors as the issuance was well received and oversubscribed by 5 times. We would also like to give special praise to KAMCO and KFH Capital for their support and local marketing efforts in relation to this successful issuance. The raised funds will play a prominent role in strengthening the Bank’s Capital Adequacy Ratio and assist in implementing our strategic corporate objective. This issuance marks a great achievement not only for Warba, but also for the Islamic Banking sector. In addition to that, we would also like to thank the Central Bank of Kuwait and the Capital Markets Authority for their ongoing support and cooperation.”

Mr. Faisal Sarkhou, Chief Executive Officer of KAMCO, a leading investment company with one of the largest AUMs in the region, said, “We are proud to have played an active role in successfully completing Warba’s Tier 1 Mudaraba Capital Certificates. We consider this sukuk issuance to be yet another building block in supporting the Kuwait capital markets. We progressively work towards developing and enhancing the private sector and Kuwaiti economy through diverse investment opportunities. We value our Investment Banking and Wealth Management teams in consistently undertaking roles in key announced transactions, while putting forth their experience and credibility to deliver the best possible outcome for our clients during each transaction process.”

Chief Executive Officer - Abdulaziz Nasser Al-Marzooq of KFH Capital, the investment banking arm of KFHGroup stated, “This issuance is considered as an important step towards strengthening the role of Sukuk as a major financing instrument for governments and corporates alike. He added that Sukuk performance represents an important part of the global financing market. He further stated that KFH Capital has succeeded in acting as a lead arranger and bookrunner on two out of three Sukuk issuance out of Kuwait. Recently, KFH Capital was successful in arranging & distributing the Sukuks for Boubyan and Warba banks. This affirms the company’s unremitting efforts and pioneering role in the Sukuk market at the regional and global levels.

He reiterated that KFH Group is exerting continuous efforts to achieve the goal of establishing a deeper secondary Sukuk market for the tradability of Sukuk. This would make the Sukuk more liquid and easy to trade, thereby, widening its customers’ base and attracting more investors. It will also allow Sukuk to penetrate new markets covering different currencies. KFH Group is recognized as a market leader in terms of issuing Sukuk for various governments and corporates across the world, which has provided a boost to the Sukuk industry as awholewitnessed by the remarkable growth due to investors’ confidence within the global markets.

KAMCO and KFH Capital acted as Joint Lead Managers & Bookrunners for Warba Bank Sukuk issuance

Saturday 18 March 2017